Why “Saving on the Loan” (as part of Inverse Commission) is the strongest buyer protection—for buyers and their agents

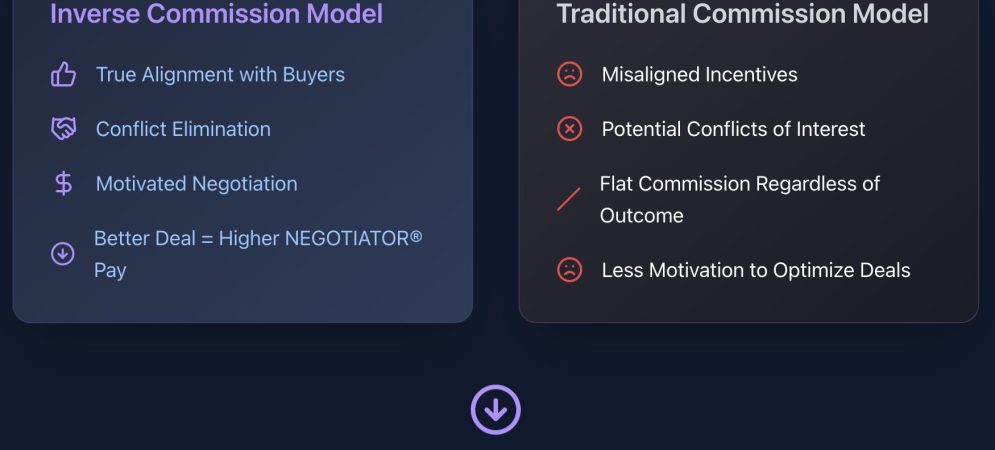

Most buyers think the biggest win in a home purchase is negotiating the price down. That matters—but the most dangerous (and most expensive) surprises often live in the financing: rate structure, lender fees, discount points, lender credits, and what happens when underwriting meets real life. That’s why folding loan savings into a buyer-first compensation model—Inverse Commission / Commission on the GAP™—can become the single best protection mechanism for both the buyer and the buyer’s representative (the NEGOTIATOR®), especially in today’s rapidly changing buyer-broker landscape. Below is a research-backed breakdown of why financing savings belongs inside the “savings-driven” Inverse Commission framework,…

Read More