Revolutionizing Buyer’s Agency with the Paris Paradigm

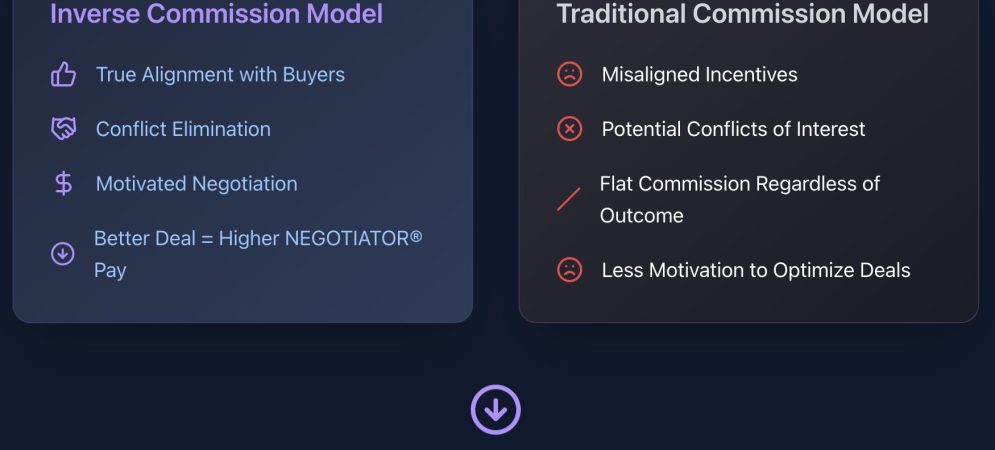

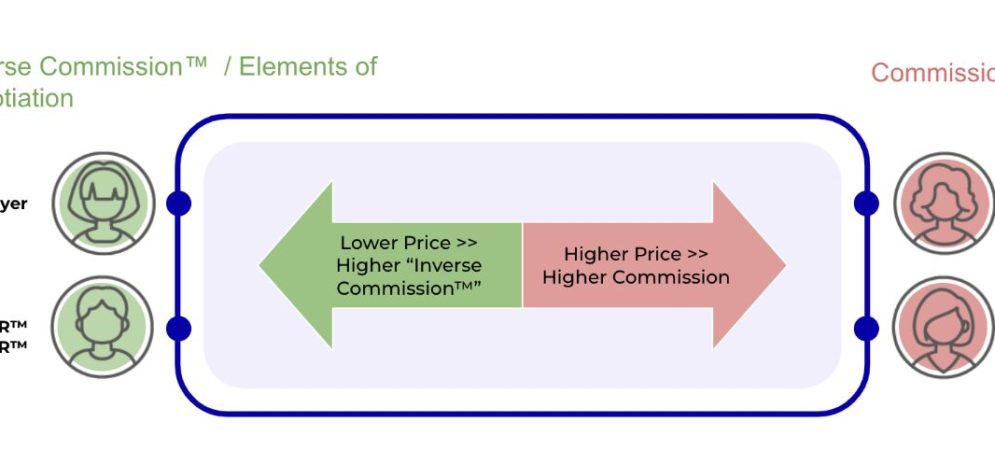

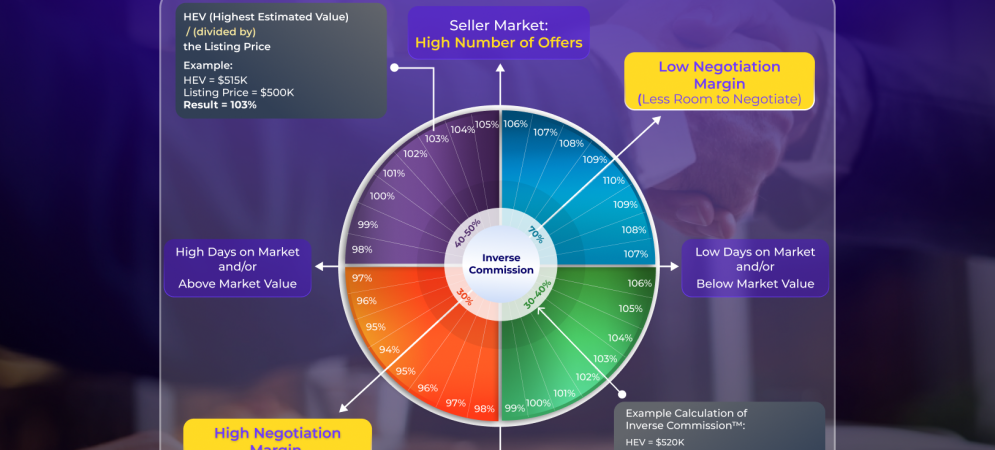

Ever felt like your agent’s incentives weren’t fully on your side? With the Paris Paradigm’s Inverse Commission™ and NEGOTIATOR® designation, we’ve flipped the script: Performance-Based Buyer’s Agency No more fixed-percentage fees that ignore effort. Now, the harder your agent negotiates your savings, the more they earn—and if there’s no savings, you pay nothing. Inverse Commission™ Agent fees come directly from the savings they secure for you. Example: House Highest Estimated Value (HEV) at $500 K → Bought at $490, negotiated $10K fixing the roof by seller, negotiated $5K of closing cost to be paid by seller, Difference = $25…

Read More