Traditional Buyer Agency compensation models can unintentionally create awkward situation of conflicts of interest, particularly when it comes to the buyer’s closing costs.

Certain incentives offered by providers for selling services to the buyers. Most of these services are necessary, but in rare cases, they may be tagged as “unnecessary” costs.

Why a NEGOTIATOR® cannot be accused of such practices?

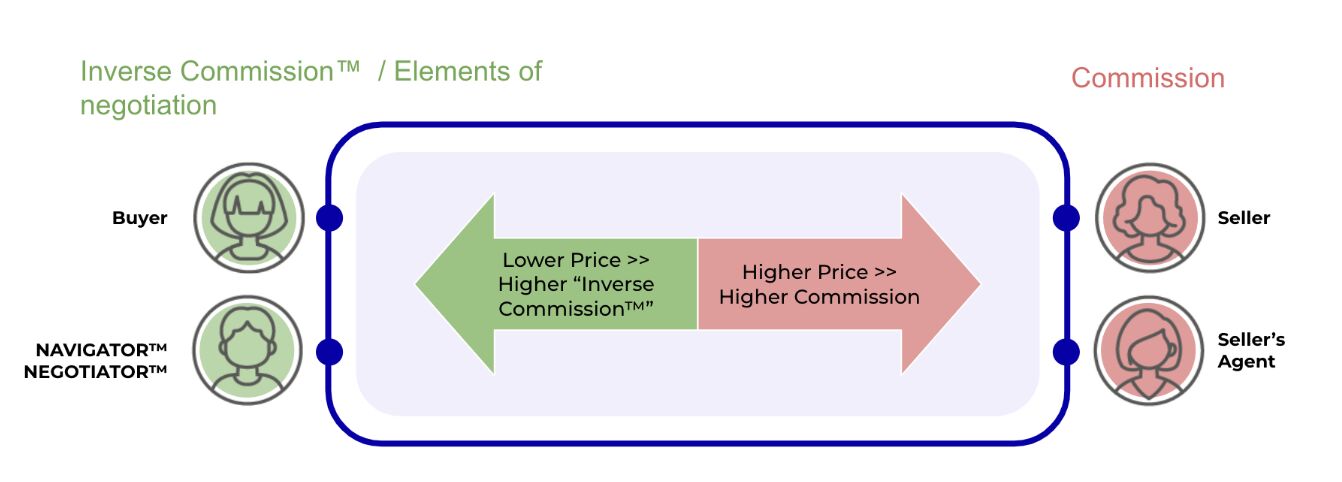

NEGOTIATORS® are systematically Incentivized To Eliminate Unnecessary Costs: “Inverse Commission” or “Commission on The GAP”.

1. The HEV (Highest Estimated Value) Accounts for All Costs.

The HEV includes all costs related to the deal, ensuring total transparency.

- This is why the buyer’s budget should match or exceed the HEV.

- It creates a clear framework where every expense and saving is accounted for under the GAP. (Similar to Profit and Loss).

2. All Income Contributes to the GAP.

Any income the NEGOTIATOR® receives because of the transaction – whether it’s a affiliate check, bonus, or other offered income – directly adds to the GAP.

- This ensures the buyer benefits from every dollar saved because as the GAP grows, so does the NEGOTIATOR®’s compensation.

3. No Incentive to Add Unnecessary or Fictional Costs.

Unlike certain claims in the traditional system, NEGOTIATORS® have no financial incentives to inflate closing costs and even it can cost their paycheck dearly! (Inverse Commission).

NEGOTIATOR® has no benefit to see buyer pays more or leaves money on the table for any reason.

Here’s why:

- Adding unnecessary costs shrinks the GAP, directly reducing the NEGOTIATOR®’s compensation. Even if a NEGOTIATOR® receives an affiliate paycheck for a certain service for buyer (e.g. Home Warranty), based on the contract of NEGOTIATOR® it should be returned to GAP. This will make such bonuses fully transparent for the buyer and even make it zero-sum for the NEGOTIATOR® to take the maximum possible “discount” or receive the “affiliate” paycheck and pass it to GAP.

- Even if some costs are added as “credits taken from the seller,” they won’t increase the NEGOTIATOR® Inverse Commission™ pay. Future buyers value success records of Real Savings more than Taken Credits and savings will be rewarded in Inverse Commission with the same percentage as provisioned credits.

- By reducing costs, the NEGOTIATOR® grows the GAP, earns more, and proves their dedication to the buyer’s best interests.

In Summary:

The GAP represents savings and credits achieved for the buyer.

The Inverse Commission™ model ensures there’s zero financial incentive for the NEGOTIATOR® to inflate costs-unlike traditional models, where Pro agents are NOT rewarded for their hard work toward buyer’s savings.