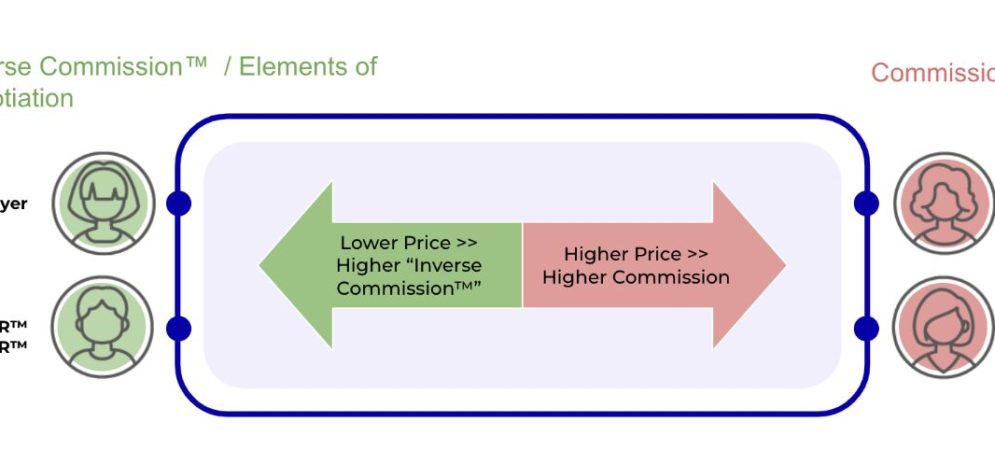

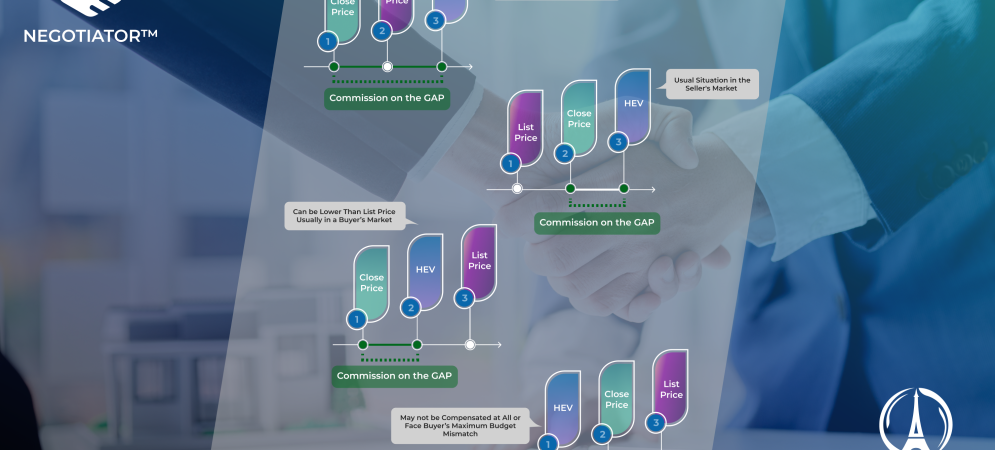

How the Inverse Commission™ Model Solves Rare Cases of “Unnecessary Costs” in the Buyer Agency?

Traditional Buyer Agency compensation models can unintentionally create awkward situation of conflicts of interest, particularly when it comes to the buyer’s closing costs. Certain incentives offered by providers for selling services to the buyers. Most of these services are necessary, but in rare cases, they may be tagged as "unnecessary" costs. Why a NEGOTIATOR® cannot be accused of such practices? NEGOTIATORS® are systematically Incentivized To Eliminate Unnecessary Costs: "Inverse Commission" or "Commission on The GAP". 1. The HEV (Highest Estimated Value) Accounts for All Costs. The HEV includes all costs related to the deal, ensuring total transparency. This is why…

Read More